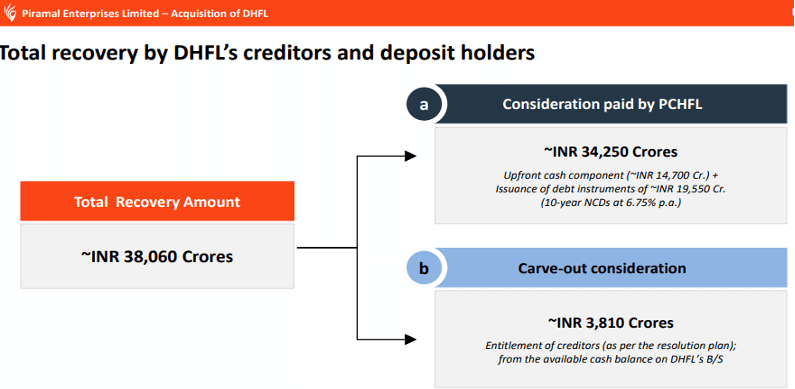

On September 29, the Piramal Group announced the completion of the Dewan Housing Finance Corporation (DHFL) takeover at INR 38,060 crore. In an announcement made by the Piramal Enterprises Limited, they revealed that an amount of INR 34,250 crores was being paid as the consideration paid and amount equivalent to INR 3,810 Crores was allotted towards the entitlement of creditors (as per the resolution plan), from the cash balance available with DHFL.

The total consideration paid by the Piramal Group at the completion of the acquisition includes an upfront cash component of INR 14,700 crore and issuance of debt instruments of INR 19,550 crores (10-year NCDs at 6.75 percent p.a. on a half-yearly basis).

The new entity post acquisition of DHFL will be named as Piramal Capital and Housing Finance Ltd (PCHFL) and will be the wholly-owned subsidiary of PEL.

DHFL resolution- Key highlights

With this take over, the DHFL case becomes first ever case of a financial service company to be resolved through the Insolvency and Bankruptcy Code (IBC).

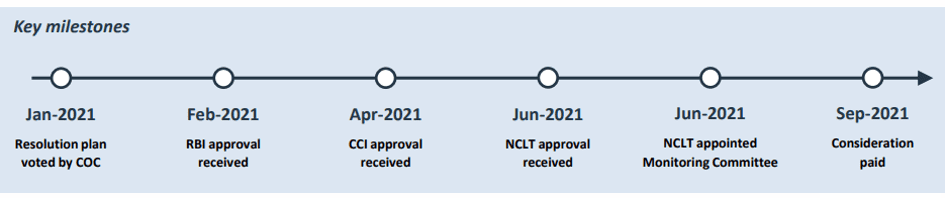

The Piramal Enterprises Limited (PEL) also clarified that more than 90 percent of the Committee of Creditors (COC) voted in favour of PEL resolution plan in January ,2021 which later was approved by the Reserve Bank of India (RBI). Months after attaining approval from RBI, the Competition Commission of India (CCI) issued its approval, followed by National Company Law Tribunal (NCLT) approval.

Out of the reported 70,000 creditors of DHFL group, majority of them stand to recover around 46 percent of the amount through successful completion of the resolution process.

PCHFL will have access to over 10 lakh customers across 24 states and a network of over 300 branches and 2,338 employees making it one of the leading housing finance companies in India.

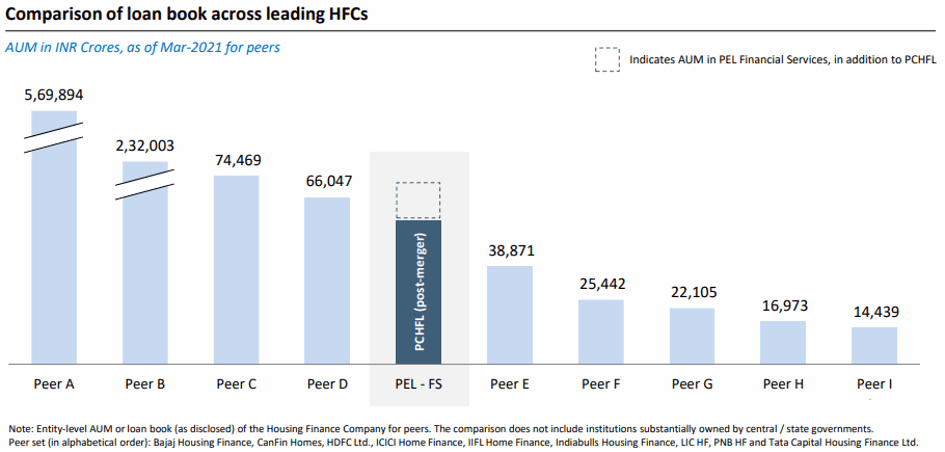

The comparison of loan books across leading Housing Finance Companies as per PEL reports places PCHFL among top 5.

This acquisition will further improve the asset liability management of PEL group and has been welcomed by the DHFL creditors (including FD holders).

PCHFL will offer services such as used cars and two-wheeler loans, education loans for vocational and online courses. Small builder finance to meet construction finance requirement, unsecured business loans, personal loans and loan against securities.