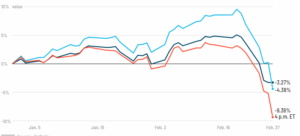

US stocks again sold off sharply on Thursday as worries about coronavirus mounted. The S&P 500 posted its worst day since August 18, 2011, and the three main indexes fell into correction territory. Stocks are on track for their worst week since the financial crisis.

The Dow (INDU) dropped 1,191 points, or 4.4% in its worst one-day point drop in history. The index has fallen more than 10% below its most-recent peak, putting it in correction.

The S&P 500 (SPX) closed down 4.4% and finished the day below the 3,000 point mark. The index is also in correction territory.

The Nasdaq Composite (COMP) ended down 4.6%, more than 10% below its latest peak.

All three indexes are on track for their worst week since the fall of 2008, the midst of the financial crisis.

In the United Kingdom, the FTSE 100 (UKX) also fell into correction territory Thursday. This is the market’s first correction since December 2018.

In the energy space, US oil prices fell yet again as investors worries about a drop in demand. US oil futures settled down 3.4% at $47.09 a barrel.

Worries about the coronavirus outbreak mounted this week, with the US Centers for Disease Control and Prevention saying it expects cases in the United States to rise. The virus has now infected more than 82,000 people worldwide, with the vast majority of cases in China.

Corporations continue to warn that they won’t meet their first quarter earnings targets. Microsoft (MSFT) announced that late Wednesday. Goldman Sachs (GS) said in a report Thursday that it now thinks US companies will generate zero earnings in 2020.

Disclaimer : This post is independently published by the author. Infeed neither backs nor assumes liability for the opinions put forth by the author.