The government’s varied relief measures for the automobile sector turned out to be a damp squib. While the broad markets rallied around 2% on Monday on hopes of a better tomorrow, the Nifty Auto index closed only 0.49% higher from the previous trading session. Stocks of leading automobile manufacturers Maruti Suzuki India Ltd, Bajaj Auto Ltd and Hero MotoCorp Ltd fell.

Here are seven reasons why there is scepticism among investors that the slew of measures, which finance minister Nirmala Sitharaman announced last week, will revive auto sales.

One, the increase in depreciation rate by an additional 15% (existing 15%) for vehicles purchased from now till 31 March 2020, will not boost sales. For passenger cars, there is some confusion whether the higher depreciation is for vehicles bought for personal use or by businesses.

As for commercial vehicles, nearly 75% is owned by small operators or single-truck owners. Given the incessant fall in truck rentals and weak capacity utilization, the owners are struggling to even clock profits. This makes higher depreciation, which lowers taxable profits, meaningless.

Two, the decision to withhold the multifold (8 to 40 times) hike in vehicle registration fees has no material impact. In any case, the increase had not been implemented yet.

Three, the auto industry’s biggest demand—a cut in the goods and services tax—was not met. This would directly lower the price of a vehicle for the consumer and drive sales. But given the fiscal position of the government, this was too much to expect.

Four, there is no incentive to boost demand for two-wheelers, which comprise 80% of domestic auto sales.

Five, the rate cut transmission may help sectors such as real estate to a larger degree than the auto sector in stimulating demand. After all, the reduction in EMIs (equated monthly instalments) is more meaningful for house purchases, which are much larger in terms of value.

Six, lifting the ban on buying vehicles to replace old ones in government departments is unlikely to translate into big orders for original equipment manufacturers. This segment’s contribution to overall sales is limited.

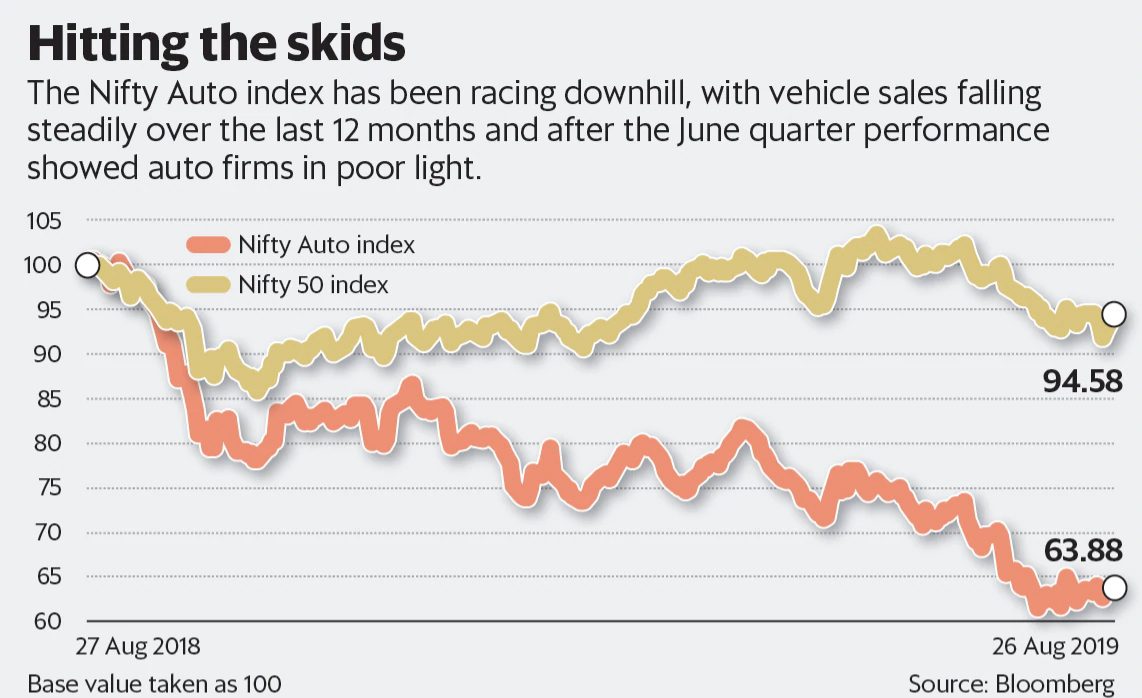

Seven, the auto sector is still reeling under the slowdown and facing job losses, high inventories, dealership closures and drop in profitability of companies. The feeling in the industry is that much more needs to be done for a revival.

According to Prayesh Jain, executive vice president at Yes Securities (India) Ltd, “Announcements can boost short-term sentiment. Depreciation benefits may boost CV (commercial vehicle) demand to some extent, but ground realities of weak economic environment need to change for a tectonic shift in demand.”

Perhaps, a scrappage policy to replace old vehicles with new ones may drive sales of both commercial vehicles and passenger vehicles.

Ultimately, auto sales go hand-in-hand with growth in gross domestic product, estimates for which have been scaled down for fiscal year 2020.